Save $500-$600 Per Qualified Full-Time Employee Every Year

How Do We Do It?

We utilize a little known tax code strategy in the Affordable Care Act. These tax codes were recently updated by congress to promote preventative wellness benefits for employees.

What Tax COdes Are Used

Full Compliance wITH

Who Are Our Clients?

We work with Any Size employer in the United States

hOW is there no Net cost?

payroll tax advantage uses updated tax codes from the ACA to reallocate payroll tax savings to pay for employee benefits. see below to learn how this strategy works without any reduction in your employees' net pay.

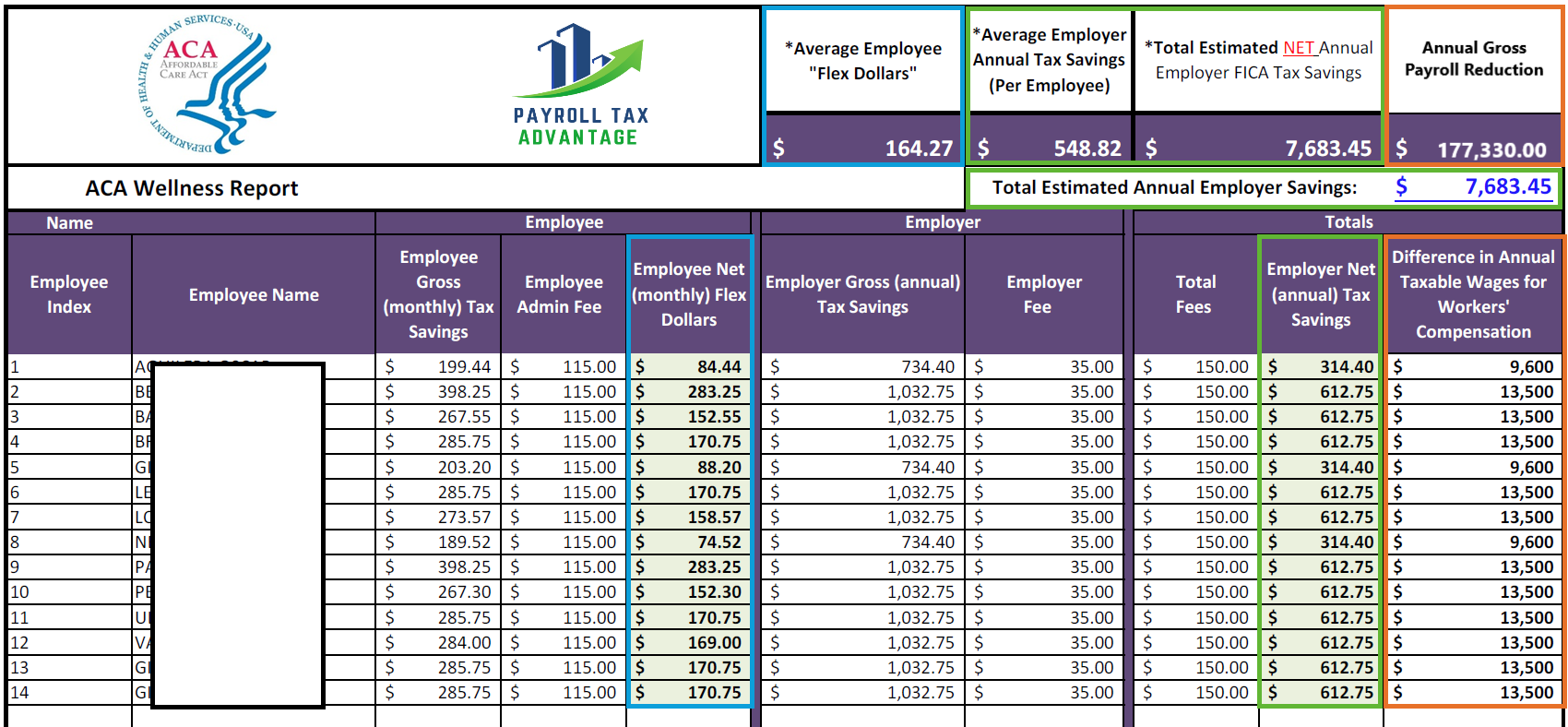

$565

AVERAGE PAYROLL TAX SAVINGS PER QUALIFIED EMPLOYEE

22%

AVERAGE WORKER'S COMP INSURANCE SAVINGS

$145

AVERAGE EMPLOYEE FLEX $ TO SPEND ON INSURANCE

eXAMPLE from A 14 EMPLOYEE CLIENT WE HELPED

No Net Cost employee wellness benefits

Payroll tax advantage can help your qualified full-time employees get preventative care wellness benefits at no net cost. we partnered with first-in-class wellness provider, Amaze Health, so your employees will have the wellness resources they need to thrive. amaze health offers 24/7 unlimited telemedicine doctor visits with no copay for physical and mental health.

Our wellness benefits Provider

Employees' Family also Get Our Wellness Benefits

Learn About Amaze health